Payments Online- When dealing with late-paying tenants, it may seem as if it doesn’t matter what form your rental earnings come in. Rent is paid as long as the cash leaves their bank account. Unfortunately, that is not always the case. Unfortunately, things happen, and payments could go missing, leaving you or your landlord responsible. Use the safest rent payment method to avoid errors while paying your rent.

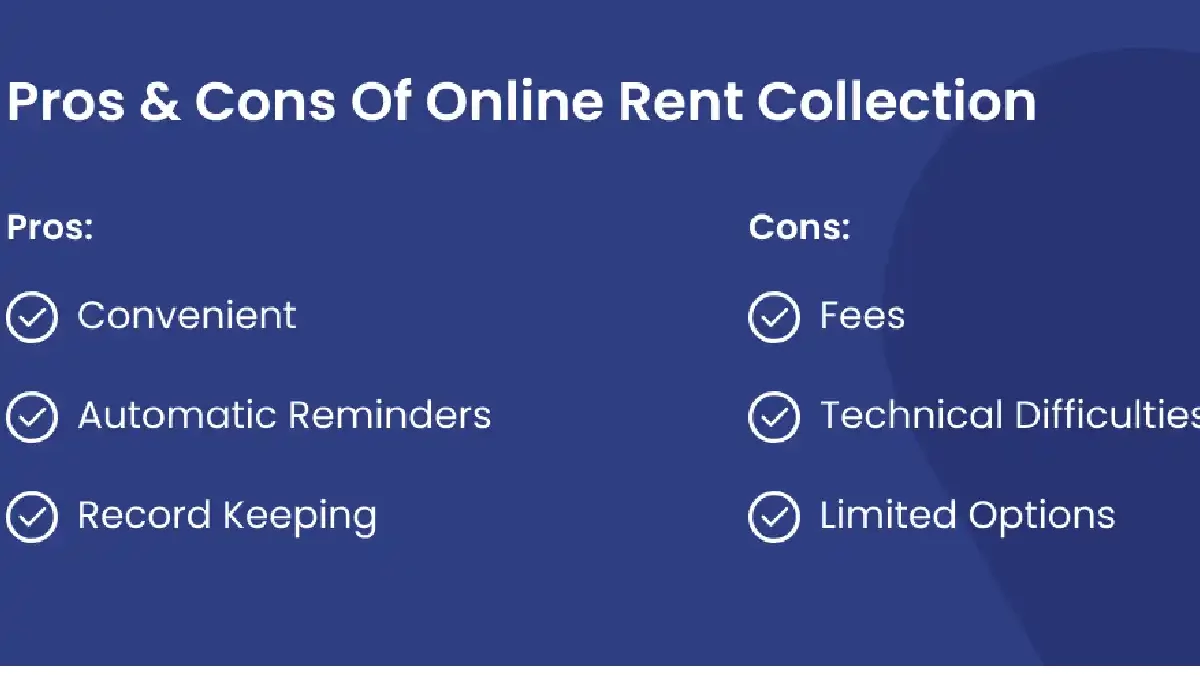

Online rent payments are one of the most effective ways to collect rent regularly. You can use an online rent collection technique to set up a payment plan, accept debit or credit cards, and monitor your tenants’ payment history. However, tenants benefit from an online rent payment method as well. They can set up future billing, pay by direct deposit, or select various payment options.

Whether you are staying at these luxurious Renew Midtown Apartments Atlanta GA or have a small or large rental portfolio, getting your rent payment on time is a top priority. Join us as this article discusses the pros and cons of collecting rent payments online and reviews the top three rent collection apps.

Table of Contents

Pros of Collecting Rent Payments Online

1. It saves time

Rent collection online saves time for both you and your tenants. There will be no more trips to the post office to collect rental checks and then to the bank to deposit them. However, after depositing the check, you will have to wait several days for the funds to clear. If the check bounces, landlords will need to spend even more effort contacting the tenant, potentially risking an ugly confrontation.

You can do some of the work by setting up a digital wallet to accept online payments, allowing your tenants to use the service to pay rent. In addition, many steps you once had to take are eliminated because the transactions are handled digitally.

2. It is secure.

Renters can be persuaded to pay online since it is safer than paper checks, which is one advantage. In addition, sensitive information that tenants send through the mail contains information that, in the wrong hands, could lead to identity theft. Online bank transactions are encrypted to lower the possibility of identity theft.

Another advantage of online rent collection for landlords is that you don’t have to provide your tenants access to private information. With a mobile app, your tenants can pay their rent. This way, your financial information is protected, as is the financial data of your tenants. In addition, you can use property management services to track income and expenses securely.

3. It reduces errors

Rent tracking errors can be costly if you make them in your bookkeeping. There are numerous ways you can make basic mistakes, from failing to realize that you were underpaid to failing to collect the appropriate late fees.

Basic accounting features are often included with online rent payment platforms, helping to avoid typical mistakes. Many problems can be resolved by switching from paper to online rent payments. Moving online can help you avoid some of the most frequent issues, such as incorrectly balancing a spreadsheet and forgetting to monitor transactions. It is now simpler than ever, thanks to online rent payment systems.

4. It improves landlord-tenant communication

Communication and accountability between tenants and landlords are essential. Tenants feel more at ease with their property owners when they are provided with all vital information. On the other hand, landlords are most at ease when their renters follow protocol without duress.

Setting up online payment platforms allows tenants to examine their payment history, analyze any charges they are asking for, and make payments 24/7. When renters could only pay mostly with a check, this was not the case.

Landlords will also be able to monitor when payments are made and who is still late. Tracing paper trails on who sent what rent can be difficult, but with online rent payments, verifying this data online is very simple.

Cons of Collecting Rent Payments Online

1. Partial payment

Online rent payment systems make things easier and guarantee safety for landlords and renters. However, with online payments, there is a chance that a renter might send only a partial payment, which you can’t prevent. As you will be perceived as having accepted a rent payment, this could halt any eviction proceedings that are currently underway.

2. Disputed Transactions and Chargebacks

There are also certain risks to consider. For example, there are various instances where a renter may dispute a credit card charge, making the landlord responsible for the chargeback. While most processors back their clients up to a respectable sum, frequently, this is nowhere near the average rent payment.

3. Inability to use automation for recurring payments

Some online payment platforms do not allow automation for recurring payments. If you have a fixed payment to pay out every month, tenants must manually make a payment on each occasion.

Landlords find this inconvenient because they have to remind their renters to make payments rather than just taking payments that come in automatically at set intervals.

Top 3 Apps for Rent Collection

1. PayRent

PayRent encompasses added services such as monitoring and reports, rent reminders, and partial or complete payment options for a full-service approach to rent collection. Additionally, PayRent assesses a small fee based on the nature of each transaction. Payment with this app accepts e-checks or credit cards, and the owner receives the money in 3 business days.

2.RentTrack

RentTrack is well-liked by tenants because it accepts e-checks and credit card payments. In addition, RentTrack reports payments to all three credit bureaus, which is the critical reason. Therefore, encouraging timely payments will help establish a solid credit history. This platform also offers landlords same-day funds, which is a huge plus. Although there are costs involved with this service depending on the method of payment, many landlords think it is worthwhile.

3. Cozy/Apartments.com

This app provides landlords with customizable options on a user-friendly platform at various price points. Starting with a free version, this allows users to pay online using a checking account. However, there is an additional cost if tenants want to pay by credit card.

Conclusion

In recent years, technology has advanced significantly. As a result, more resources than ever before are available to help both landlords and tenants live more comfortably. If you haven’t thought about learning how to collect rent payments online, this might be the ideal time.